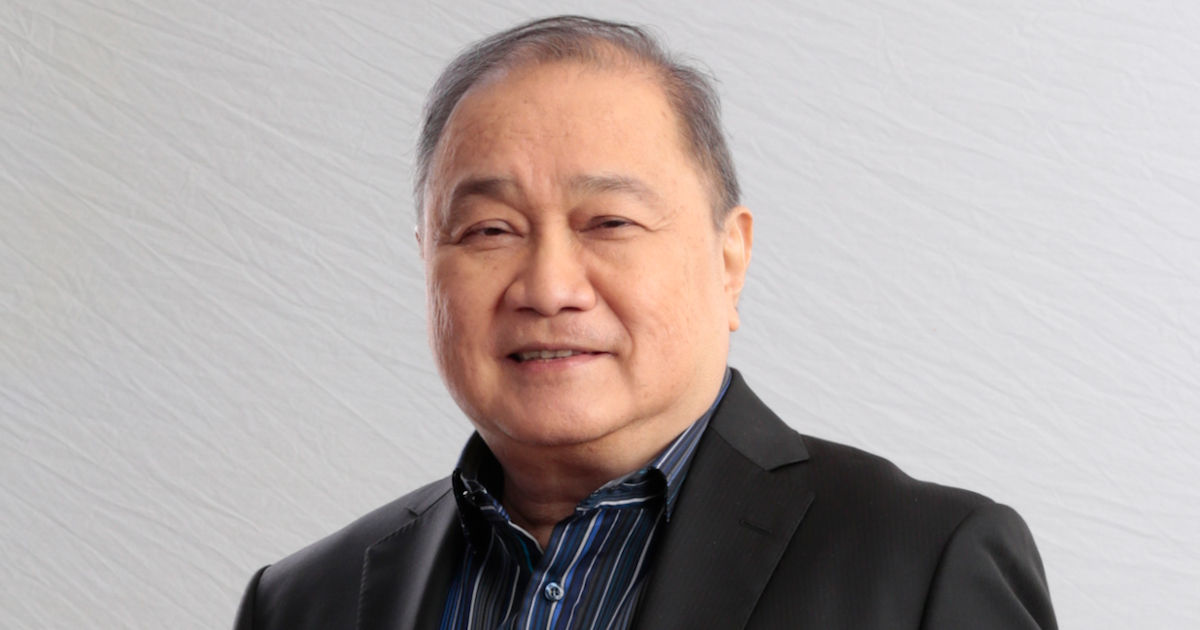

Robust digital connectivity needs in one of the world’s longest lockdowns leads First Pacific’s portfolio in the first half of the year in the Philippines, says Managing Director and CEO Manny V Pangilinan. First Pacific Company, locally known as the MVP Group of Companies, includes basic services such as telco, power, water and transport.

Standout: Telco

Pangilinan said the group’s telco business PLDT proved to be a standout, amidst the pandemic, outpacing performances in its power and water businesses, which turned in lower growth.

“The advantage we have in our portfolio is that our three basic businesses cater to the basic needs of the people — power, water and telecoms,” says Pangilinan, who is also Chairman of PLDT Inc (TEL PM), Metro Pacific Investments Corp (MPI PM) and Manila Electric Company (MER PM). “Because of the recession, demand has generally been down, especially in the 2nd quarter, albeit only moderately for power and water for this period. The main exception is the telco business because revenues have been robust for the first half.”

PLDT Inc. reported higher earnings in the first half of the year. Telco core income rose 5 percent year-on-year to Php13.9 billion mainly due to higher data and broadband service revenues. PLDT hiked its capex to Php70 billion for 2020 in response to increased demand for digital connectivity.

Power, water, tollways

Infrastructure holding firm Metro Pacific Investments (MPIC), which has interests in Meralco, Maynilad and Metro Pacific Tollways Corporation, saw a 38 percent decline in core net income year-on-year. Power business Meralco saw a 14 percent drop in core income year-on-year. Power accounted for P5.2 billion or 68 percent of MPIC’s net operating income, Tollroads contributed P915 million or 12 percent, while Water contributed P1.8 billion or 23 percent.

Pangilinan cited the transport business as the hardest hit in the portfolio, as restrictive quarantine measures kept commuters away from tollways to trains. But the tollways business has seen a recovery in traffic since, from its initial drop in April when the lockdown began. “Traffic went down to as low as 10% of pre-COVID 19 levels. It has now been restored to 80%. It’s cash flow positive.”

Slowing economy

The first-half performances from telco to transport were announced as the Philippine economy falls into recession, contracting by 0.7% in the 1st quarter, and a further 16.5% in the 2nd quarter — its largest drop since 1981 as enhanced quarantine restrictions stifled business activity. The Government has since reverted to a stricter lockdown on Metro Manila, which accounts for nearly 40% of GDP, to stem the continued rise in the number of COVID-19 infections.

While Pangilinan cited water, power and telco as staple requirements in a lockdown, he cited the risks of negative economic growth on people’s ability to pay for basic services. “Demand will always be there because those are very basic requirements,” he says, “so the question is whether it will continue to grow, or there will be reasons that will cause demand to drop off simply because people may have lesser means to pay.”

Regulatory environment

Economic risks aside, Pangilinan also addressed concerns over emerging regulatory risks. The Philippine Government is now looking at amendments to the concession agreements of the two Metro Manila water concessionaires. Maynilad awaits the terms of the Government’s proposals.

“What the Government has done with respect to the water concessions is organize a committee composed of economic and senior members of the Cabinet,” he says. “The Government has engaged the services of the Asian Development Bank to be the independent adviser to the Government. There’s been a lot of work the Committee has done together with the ADB. It sort of moves on a weekly basis, so we should just be ready on what is eventually served up to us. Matters relating to corporate income tax and the letter of undertaking are probably some of the key issues. The rest are provisions which can probably be agreed. Matters which impact our ability to raise financing from banks to finance our program commitments to the Government are important to us.”

On the telco side, Pangilinan praised the Government’s move to remove roadblocks and expedite the build out of towers needed to strengthen connectivity. “I think that’s good news for the telcos, we could benefit from that. So what else do we need? We suggested the adoption of certain standards that are used by international independent rating agencies like Ookla or Open Signal to measure us. In this regard, we are thinking of submitting an ideation paper to the Government along these lines.”

The world’s leading internet analysis firm Ookla found that Smart and PLDT maintained their position as the fastest mobile and fixed internet service providers in the Philippines, respectively, in the first half of 2020.

“So we’re guardedly optimistic for the second half but on the whole we expect overall performance to be quite good for the second half of 2020,” says Pangilinan. “It’s a chance to reposition the Group and rebuild it in the digital world. I think we are ahead of others in this regard.”

Hong Kong-listed First Pacific Company Limited is an investment management and holding company operating in the Asia Pacific region.